Southern Hemisphere Cashew Harvest Update: Insights from Tanzania’s 2024 Season

As the Southern Hemisphere cashew season progresses, Tanzania—a key cashew-producing nation—has entered its critical harvesting period. This year’s harvest and initial auctions offer a snapshot of market dynamics and potential supply trends, with implications for both raw cashew nut (RCN) prices and kernel prices on the global stage. Here’s an in-depth look at the latest developments and emerging patterns from Tanzania’s cashew auctions and the broader cashew market.

Current Harvest Status in Tanzania

The Southern Hemisphere harvest is well underway, with Tanzania at the forefront, holding its first cashew auctions over the past few days. So far, around 100,000 tons of cashews have been auctioned, marking a productive start to the season. Although initial auction prices were high due to early demand, prices have since stabilized, aligning more closely with global market levels as the volume of available crop increases.

Tanzanian Crop Forecast

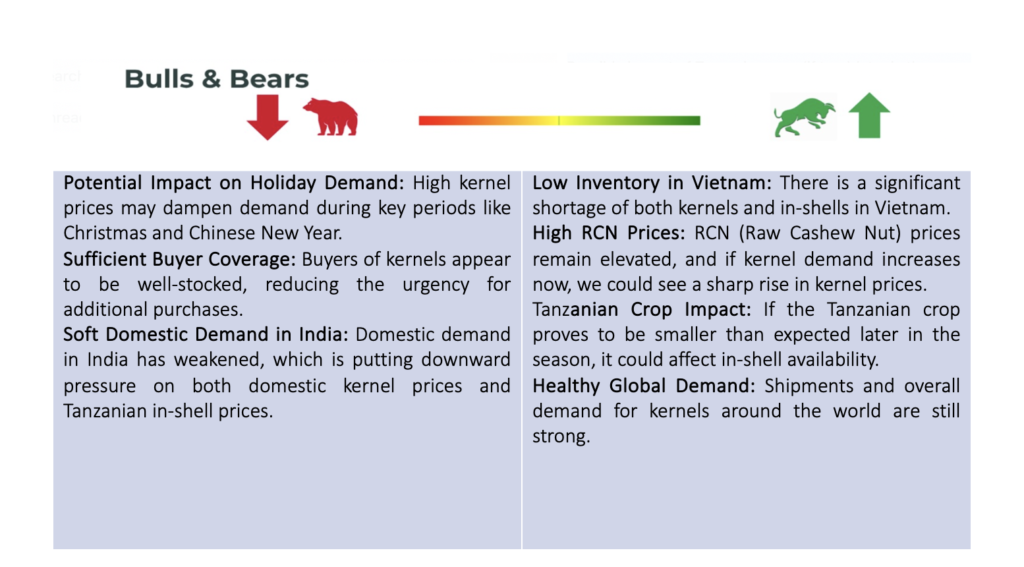

Reports suggest that the Tanzanian crop has made a strong start, with an anticipated first flush of approximately 140,000 tons. However, early feedback from local sources indicates potential challenges in reaching the crop forecasts initially set for this season. The second and third flushes—the additional waves of harvest—are reportedly not as productive as expected. As a result, overall crop projections may be adjusted downward if these flushes continue to underperform. In the meantime, Tanzania’s auction process is likely to be paced in response to the ongoing assessment of harvest output and market conditions.

Price Disparity in Cashew Markets

A notable trend in the current market is the persistent price gap between in-shell and kernel cashews. Although Tanzanian in-shell prices have dropped from their initial highs, they remain relatively elevated compared to kernel prices. This price disparity is creating pressure for market adjustments. For a more balanced market, either kernel prices will need to increase, or in-shell prices must continue to decline to close the gap and align more closely with production and demand dynamics.

Auction Dynamics and Future Expectations

The pace of Tanzania’s future auctions will depend largely on how the harvest unfolds over the next few weeks. With early indicators suggesting a potential shortfall in the crop relative to initial projections, auction timing and volume could be adjusted to match the available supply. Analysts anticipate that a clearer picture of Tanzania’s full crop yield will emerge after another 50,000 tons have been auctioned, which will provide a better basis for evaluating total output and likely market impact.

Demand Landscape: Vietnam and India

On the demand side, trends in major markets like Vietnam and India are having a noticeable impact on prices and auction dynamics:

Kernel Market Trends

Kernel demand, meanwhile, remains tepid, with price levels largely unchanged despite the approach of major holiday seasons. The Chinese New Year and Christmas, typically significant drivers of kernel sales, have not sparked the level of demand growth seen in previous years. This subdued demand has kept kernel prices stable, and without a notable increase in purchasing activity from key consumer markets, prices may remain flat in the short term.

Market Outlook and Strategic Considerations

The Tanzanian cashew season reflects a mix of potential and challenges for the global cashew market. With an uncertain harvest outcome and mixed demand signals, stakeholders in the cashew industry may need to consider several strategic moves:

As Tanzania’s harvest progresses and the market adjusts to evolving demand patterns, the Southern Hemisphere’s cashew season will remain a focal point for the global cashew industry. By closely monitoring these developments, industry stakeholders can make informed decisions to navigate the year’s dynamic market conditions and optimize their positions in the face of both opportunity and uncertainty.