Sultana Grapes: A Comprehensive Overview of Their Origin, Production, and Differences from Raisins

Sultanas, also known as Thompson Seedless grapes in the United States, are a popular variety of dried fruit known for their sweet, seedless nature. These grapes are a key ingredient in a wide range of culinary applications, from baking and snacking to cooking. In this blog post, we’ll explore the origins of sultana grapes, their major growing regions, global consumption patterns, and how they differ from raisins.

1. Origin of Sultana Grapes

Sultanas trace their roots back to the Middle East and Central Asia, particularly in regions that now make up modern-day Turkey and Iran. The grape variety was cultivated for its seedless nature, which makes it ideal for drying into raisins. The Thompson Seedless variety, which is most commonly used for sultanas, was developed in the 19th century and is still the most widely grown variety for raisin production today.

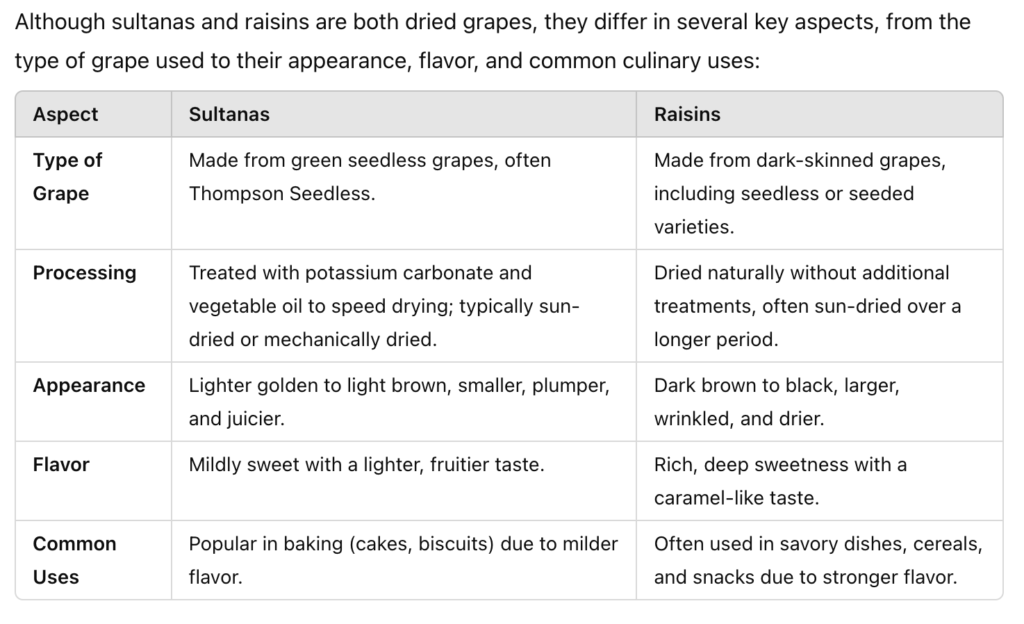

Key Differences Between Sultanas and Raisins

2. Key Growing Regions for Sultanas

Several countries around the world are known for their high-quality sultana production. These nations are responsible for meeting global demand for this versatile dried fruit. Here’s an overview of the major growing regions and their production volumes for the 2023/24 season:

3. Global Production Trends

In the 2023/24 season, the global production of sultanas and raisins is projected to reach 1.131 million metric tons (MT). This marks a 13% decrease compared to the previous year, primarily due to adverse weather conditions and crop diseases in major producing regions.

Despite this reduction, sultanas remain a key ingredient in the global dried fruit market, with Turkey, the United States, and Iran leading the way in production.

4. Main Consumer Countries for Sultanas

Sultanas are highly sought after around the world, particularly in countries with high demand for dried fruits. The following nations are some of the top consumers and importers of sultanas:

Sultana grapes are an integral part of the global dried fruit industry. Leading producers like Turkey, the United States, and Iran provide high-quality sultanas that are consumed worldwide. Their versatility in culinary applications, combined with their sweeter, milder flavor, makes them an ideal choice for baking, snacking, and cooking.

Despite their similarities, sultanas and raisins differ in processing methods, appearance, and flavor, each offering unique qualities suited to different culinary uses. As global demand for dried fruits continues to grow, sultanas will remain a staple in kitchens across the world.

Sources:

- USDA Foreign Agricultural Service (2023/24 data)

- International Raisin and Grape Industry Reports (2023)

- MUNDUS AGRI, INC, and other industry publications